The path to successful investing is not about speculating and making big bets, it is about being prepared for opportunities. Charles Darwin once said: “It is not the strongest or the most intelligent that survives, it is the one that is most adaptable to change that wins”.

This blog will give key insights and tips on how to be a successful investor.

A new world

In the past decade, we witnessed low interest rates, low inflation and a stable geopolitical landscape. But, today is a different story as the current macroeconomic environment of 2023 illustrated a shift in investment dynamics. Slow growth, high inflation, and interest rates soaring above 2% have changed the way people are investing their money.

A more volatile environment is not entirely bad for investors, this will just make risk management and portfolio diversification more important than ever.

Below are four steps to becoming a successful investor.

4 Key steps to becoming a successful investor

Risk management

Understanding your risk profile and determining the right asset allocation is essential in managing your wealth. Different investors have varying levels of risk, some prioritise capital protection while others seek higher returns. Risk tolerance is affected by factors such as investment horizon, financial goals and objectives as well as age.

With a longer investment horizon, you are more likely to allow greater tolerance of risk because you can afford the time to do so, while short-term needs require less risk.

Investors who are far from the age of retirement, have the willingness to invest in stocks and real estate that can fluctuate over long periods. Others nearing retirement age cannot afford to invest in risky assets that are vulnerable to market fluctuations and will invest in safer income-generating options such as savings accounts and bonds. Understanding your risk profile and life goals will help you make the right investment decisions.

Strategic asset allocation

To manage risk, it’s important to understand portfolio diversification and be able to spread your investments across various sectors and regions strategically. This creates a more adaptable portfolio that leads to stable returns. Adequate portfolio diversification involves including assets that respond differently to economic volatility.

The current macroeconomic environment has incentivised investors who are seeking income to shift away from the stock market and enter the bond market due to the high yields they are offering. Even if you still want to invest in the stock market, think about sectors that can absorb interest rates such as Banks and Consumer Goods that still generate revenue in high interest rate environments. Successful portfolio diversion can help you manage market volatility and maximise your financial returns.

Furthermore, owning real estate property can provide a degree of protection against high-interest rates. Rising interest rates can lead to increased rental income as people opt to rent houses instead of buying. This increases demand for rental properties. In Q2 2023, the average rental yield for prime residential properties in Dubai was approximately 6-7%.

Disciplined

Being disciplined and maintaining a long-term focus is paramount for successful investing. Emotions and short-term market fluctuations can often lead to poor judgment. By sticking to a well-thought-out investment strategy, diversifying your portfolio and focusing on long-term goals, investors can achieve more consistent and stable returns.

Informed and adaptable

Investors should be active and stay informed about market trends. The ability to adjust your investment strategy based on new information and evolving economic environments is a key factor in achieving investment success.

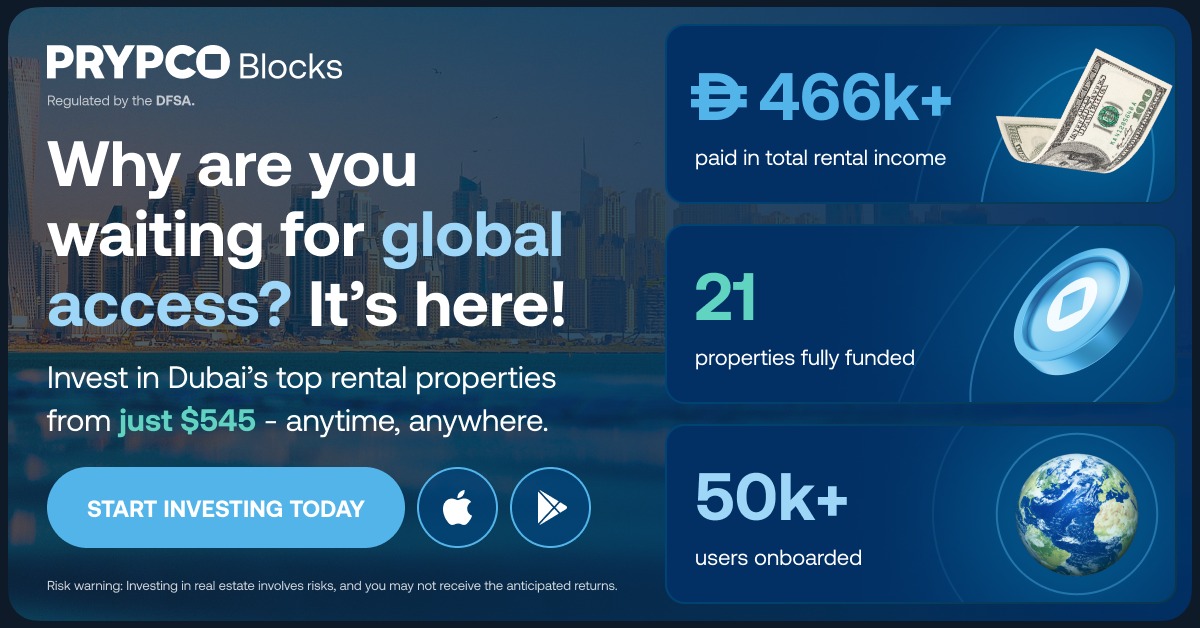

How can PRYPCO Blocks help you diversify your real estate portfolio?

PRYPCO allows you to spread your real estate investments across different assets, reducing risk and enhancing portfolio stability with fractional ownership platform, PRYPCO Blocks.

PRYPCO Blocks offers a unique and streamlined approach to real estate investment, allowing you to own parts of multiple income-generating properties with just AED 2000.