Fractional real estate is a solution that democratises real estate by allowing a group of investors to collectively own a single property through fractional ownership.

The ownership of a property is distributed by the number of shares purchased by each investor. These shares give investors the right to ownership and can benefit from rental income and capital appreciation.

In this blog, we will help you understand the facts behind fractional ownership by debunking the myths.

Myths

It is like a timeshare – false

Unlike a timeshare where you are just buying the right to stay in the property for a certain period, in fractional ownership you get to own a piece of the property. Simultaneously, it is a financial investment where you will be able to reap the benefits of owning a property such as rental income.

It is expensive – false

A timeshare can be an illiquid investment as you have not bought ownership of the property but a share that you can rent or sell to those who want to stay in the property. it extremely difficult for timeshare holders to look for buyers and exit their investments.

With fractional ownership, the value of your shares increases as the property appreciates. You also get to split the operating costs between your co-investors which reduces your financial burden of property maintenance.

It is difficult to sell – false

With fractional ownership, there are many exit window opportunities as your property appreciates. As a shareholder, you have the right to sell your shares at a higher price based on the new valuation of your property. If you want to quickly sell your fractional ownership, you can sell your shares at a discounted price which can attract more buyers.

It is not regulated – false

In Dubai, fractional real estate or any entity involved in fractional ownership of real estate is heavily regulated by the DFSA (Dubai Financial and Securities Authority). The DFSA has specific requirements for property crowdfunding licenses that all entities involved must adhere to.

For example, only residential properties are allowed to be listed and not commercial real estate such as offices. Additionally, there needs to be clear title deeds, so off-plan properties are not permitted to be listed.

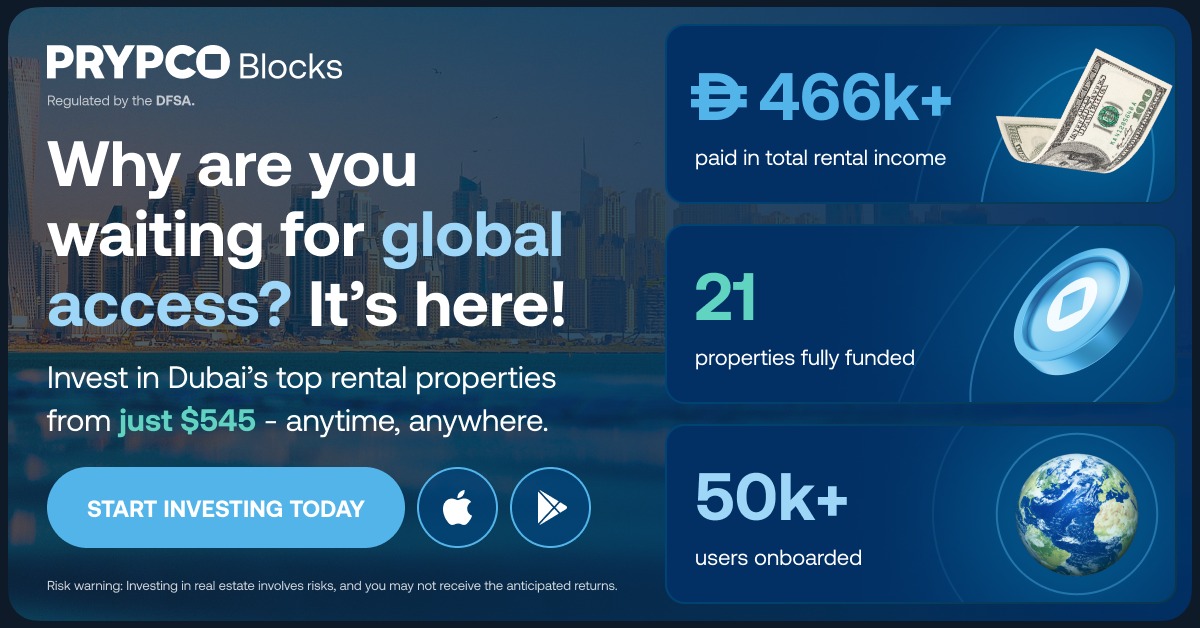

How can PRYPCO Blocks Help?

PRYPCO has launched Blocks, a platform to elevate your real estate investment game by spreading your assets across a variety of income-generating properties.

With PRYPCO Blocks, you can enter the world of fractional ownership in style with as little as AED 2000. You can be an owner of not just one property but multiple in luxurious locations in the UAE.