From iconic skyscrapers that pierce the Arabian sky to luxurious waterfront residences that redefine opulence, Dubai’s property market has it all.

Over the last 5 years, the Dubai property market has seen a 50% growth in value.

Let us explore and dismantle the prevalent myths shrouding Dubai’s property market, unveil the truths behind property trends, and offer a fresh perspective on why investing in Dubai’s real estate is beneficial for you.

Myth: Dubai’s property market is all about capital gains

Capital gains are realised when selling a property at an increased value, which is more of a long-term investment. While capital gains can be a huge incentive to invest in Dubai, it should not be the sole consideration when purchasing a property.

The most significant factor to weigh is the expected rental income that you receive, as it represents a stable source of passive earnings when leasing or renting property. The rental yields in Dubai average around 7-8%, which are among the highest in the world.

Myth: Real estate in Dubai is a bubble waiting to burst

Dubai’s real estate market is robust, with a 17% surge in property prices coupled with a rise in rental rates during the second half of 2023. This positive trend is supported by the delivery of 32,026 units in 2023, reflecting an impressive 12% year-over-year growth compared to the 28,482 units delivered in 2022.

These statistics underscore the resilience and stability of Dubai’s real estate market.

Myth: Buying property in Dubai is a lengthy process

The entire real estate transaction process, on average, takes around 30 days in Dubai. This is notably quicker than the average U.S. process, which takes 55–70 days.

Myth: The real estate market in Dubai is limited to luxury properties

Net yields are crucial when evaluating the Return on Investment (ROI) for properties. While luxury properties in Dubai’s real estate often garner attention, it’s important to recognise that economical properties in areas, such as Jumeirah Village Circle (JVC) and Jumeirah Lake Towers (JLT) can also provide competitive returns. In fact, depending on market dynamics and rental demand, these locations can sometimes outperform prime areas in terms of net yield and overall ROI.

For example, people usually seek to rent in JVC because of its affordability and proximity to important roads. So, such properties provide higher returns for you and serve as better investment opportunities in the Dubai property market. You can attain higher returns on such properties without spending a fortune.

Myth: The Dubai Real Estate market lacks regulation and transparency

Dubai has made significant strides in developing a transparent and robust legal real estate framework that facilitates a secure environment for investors.

The regulatory body, the Dubai Land Department, plays a key role in overseeing the implementation of these regulations. They also provide an open-data source providing information and detailed reports on the real estate market in Dubai.

The introduction of the Regulatory Real Estate Authority (RERA) further enhances the regulatory landscape, ensuring fair practice and protecting all stakeholders and parties involved in real estate transactions. Dubai’s legal framework consists of property registration, dispute resolution mechanisms, and guidelines for developers.

Conclusion

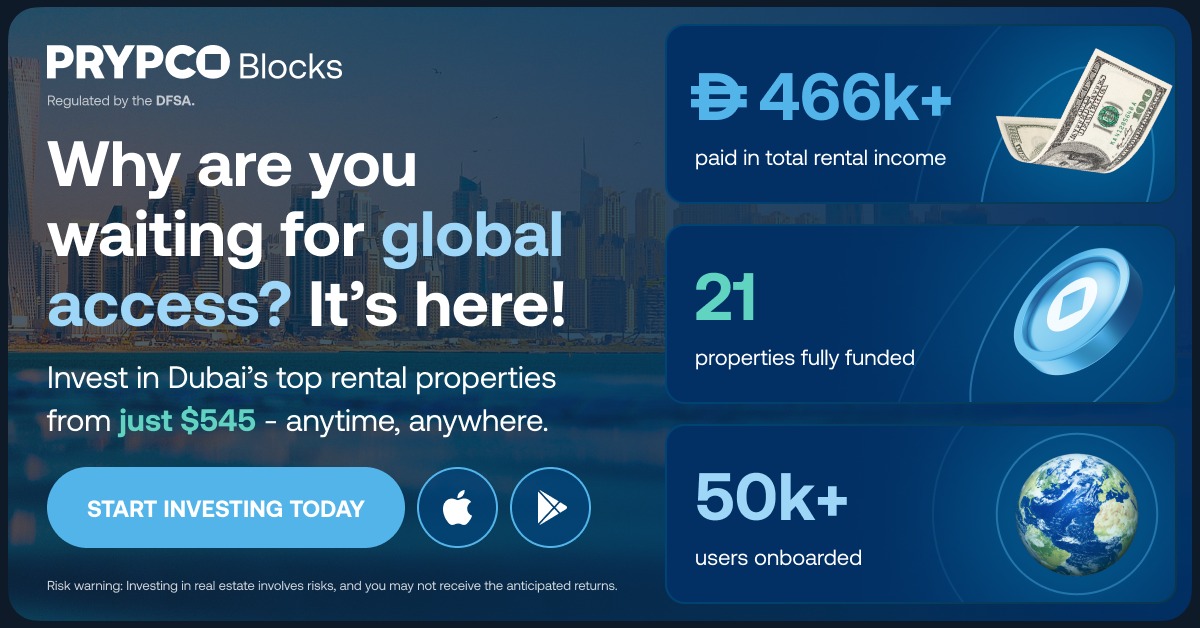

Equipped with this knowledge, you can navigate the dynamic landscape with confidence, debunking misconceptions and uncovering the true potential of real estate in Dubai. PRYPCO Blocks offers unique investment opportunities in Dubai’s real estate. With PRYPCO Blocks, you can browse through the best rental properties for free and begin to invest in Dubai’s real estate with just AED 2,000 (approx. USD 540).