Property Tokens vs Traditional Deeds is a conversation that’s redefining how we buy, sell, and invest in real estate. For decades, property ownership was tied to paper-based deeds and lengthy legal processes, but blockchain technology is transforming the landscape. Property tokens offer a digital, flexible, and transparent alternative, giving investors faster transactions, fractional ownership, and accessibility. Understanding the differences between these two approaches is key to navigating the future of real estate investment.

For centuries, property ownership has been built around traditional property deeds—paper or digital documents that legally prove ownership of a physical property. While this method is reliable and time‑tested, it comes with significant barriers: high capital requirements, long transfer timelines, and limited flexibility.

Now, property tokens, powered by blockchain technology, are transforming the way investors access real estate. With platforms like PRYPCO Mint, you can purchase fractions of premium ready-to-move Dubai properties for as little as AED 2,000, diversify your portfolio, and enjoy streamlined digital transfers.

But what exactly separates property tokens from traditional deeds, and which one should you choose? Here’s a detailed breakdown.

What Are Traditional Property Deeds?

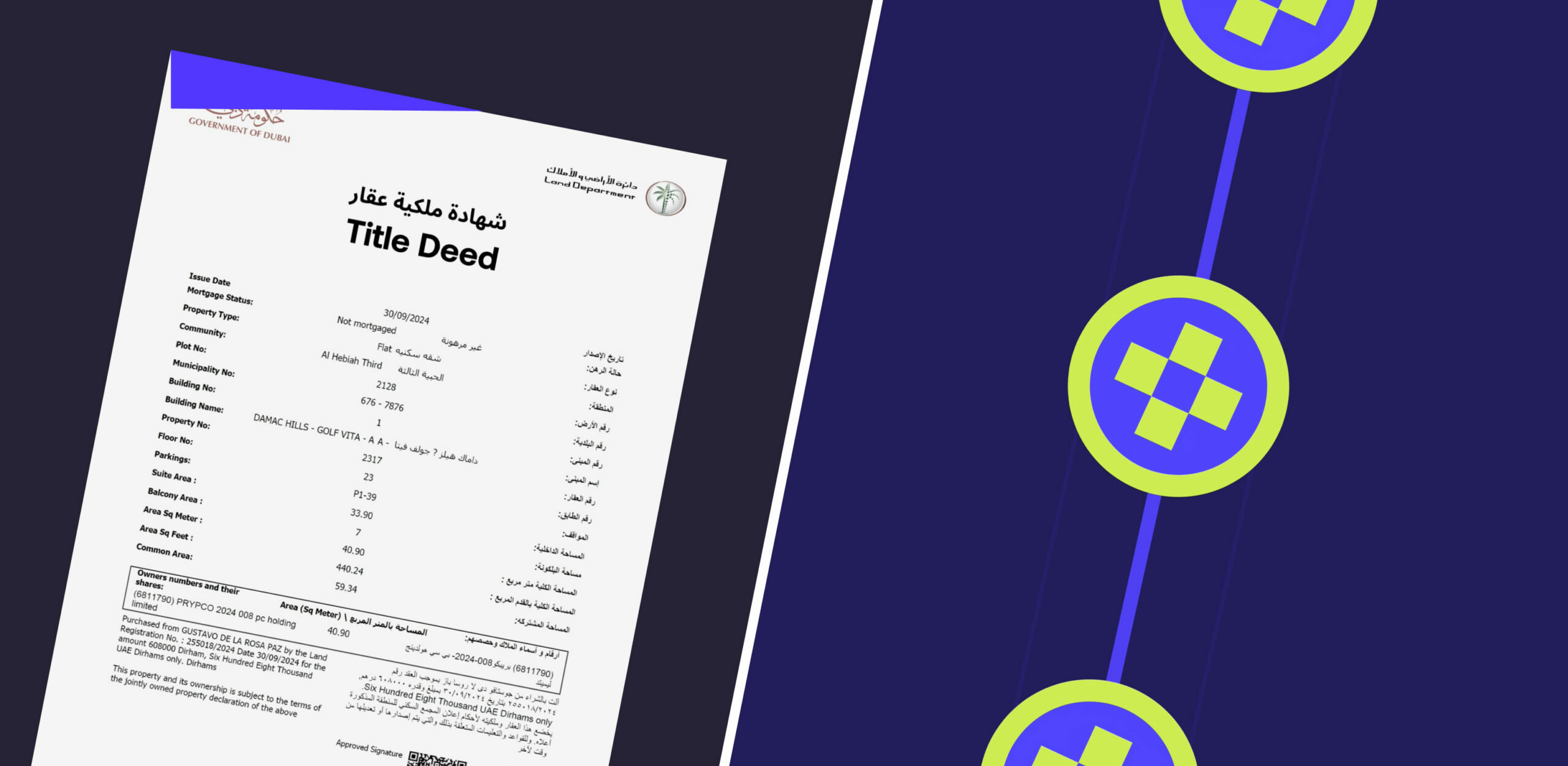

A property deed is an official legal document issued by the government’s land registry (e.g., the Dubai Land Department in the UAE) to certify ownership of a specific property.

Key features of traditional property deeds:

- They represent full ownership of the asset.

- The name on the deed is the legally recognised owner.

- Deeds must be updated whenever the property changes hands.

- Transfer processes involve physical paperwork, notary approvals, and high fees.

- Deeds are indivisible; you can’t own “fractions” of a deed without complex legal structures (e.g., joint ownership agreements or trusts).

While traditional deeds are secure, they also present challenges: properties are expensive, hard to liquidate, and require significant administrative effort to buy or sell.

What Are Property Tokens?

Property tokens represent a fractional ownership stake in a real estate asset. Through tokenization, a property’s total value is divided into thousands of digital tokens, each backed by the legal title of the property.

How PRYPCO Mint makes it work:

- Each property is legally approved by the Dubai Land Department (DLD).

- The property’s total value is divided into tokens, each tied to a share of ownership.

- Tokens are recorded on the XRP Ledger (XRPL) blockchain, creating a secure, immutable record of ownership.

- Investors receive a DLD-issued Property Token Ownership Certificate, legally confirming their fractional interest in the asset.

This system allows investors to own fractions of premium properties, enjoy pro‑rata income (e.g., rental yields), and benefit from potential capital appreciation—without the barriers of full ownership.

You might also like: The Future of Property Investment Starts in Dubai: Real Estate Tokenisation Explained

Property Tokens vs Traditional Deeds: Detailed Comparison

A) Entry Cost and Accessibility

- Traditional deeds: Buying a property outright often requires hundreds of thousands—or even millions—of dirhams. This high capital barrier locks out many investors.

- Property tokens: Platforms like PRYPCO Mint allow you to start investing from AED 2,000. This lower entry point makes real estate accessible to everyday investors.

B) Divisibility and Diversification

- Traditional deeds: A deed represents one property. To diversify, you’d need to purchase multiple properties—a financial impossibility for most.

- Property tokens: You can invest smaller amounts across several properties. For example, you could hold tokens in a Dubai Marina apartment, a Downtown Dubai penthouse, and a luxury villa in Palm Jumeirah simultaneously, reducing concentration risk.

C) Liquidity and Exit Options

- Traditional deeds: Selling a property can take months, and you can’t sell “just part” of your house if you need cash.

- Property tokens: PRYPCO Mint offers scheduled exit windows and a secondary marketplace, where investors can sell tokens to other buyers on the platform. This makes fractional ownership far more liquid than traditional real estate.

D) Transfer Process

- Traditional deeds: Transfers involve extensive paperwork, notary appointments, and government approvals. Fees can be significant.

- Property tokens: Token transfers happen digitally on blockchain, instantly updating ownership records and syncing with the Dubai Land Department’s registry.

E) Onboarding and Investor Requirements

- Traditional deeds: Buyers must undergo full legal and financial checks, often including mortgage approvals.

- Property tokens: PRYPCO Mint streamlines onboarding with a KYC-compliant digital process. UAE residents can verify their profiles with an Emirates ID and proof of address, and international investors will be added as regulations allow.

Legal Recognition of Property Tokens

Skeptical about legal standing? Property tokens issued by PRYPCO Mint are backed by the Dubai Land Department (DLD) and fall under the Real Estate Tokenization Sandbox, a framework co‑developed by DLD, the Virtual Assets Regulatory Authority (VARA), and the UAE Central Bank.

This means:

- Property tokens enjoy the same legal protections as traditional deeds, within the scope of your fractional share.

- Investors receive a DLD-issued certificate confirming ownership rights.

- Tokens are subject to VARA oversight, ensuring compliance with strict regulations on investor protection, client fund segregation, and risk disclosure.

Practical Advantages of Property Tokens

A) Diversification Made Easy

Property tokens make it possible to diversify without needing millions in capital. You can spread your investments across different property types (villas, apartments, commercial spaces) and locations in Dubai.

B) Lower Costs and Fewer Barriers

Token transfers avoid the high notary fees and complex paperwork associated with traditional deeds. Plus, you can invest without a large downpayment or tying up all your savings in a single property.

C) Access to Premium Properties

PRYPCO Mint lists properties vetted and approved by the DLD, many of which are high-quality assets in sought-after Dubai neighborhoods—assets typically reserved for institutional or ultra-high-net-worth buyers.

D) Potential Income and Capital Growth

Depending on the property, token holders can receive rental income distributions and benefit from future appreciation in the underlying asset’s value.

E) Digital Transparency and Security

Blockchain technology ensures all token ownership records are transparent and tamper-proof, reducing the risk of fraud.

You might also like: What is real estate tokenization? A comprehensive guide

Why Traditional Deeds Still Matter

Although property tokens offer many advantages, traditional deeds remain the foundation of property ownership. They’re ideal if you want:

- 100% control over a property.

- To live in the property or use it for business purposes.

- To build long-term equity in a single asset.

For owner-occupiers or investors who prefer direct control, traditional deeds remain relevant. However, they lack the flexibility and accessibility property tokens provide.

How PRYPCO Mint Bridges the Gap

PRYPCO Mint has developed a hybrid approach, combining the security of traditional deeds with the efficiency of blockchain.

- Licensed by VARA: Licensed as a broker-dealer and token issuer.

- DLD-backed ownership: Tokens are legally recognised with official ownership certificates.

- Digital liquidity: Exit windows and a secondary marketplace make tokenized investments more flexible.

- Fractional access: Starting from AED 2,000, you can own a share of premium Dubai properties.

This model makes real estate investing inclusive and dynamic, particularly for those building diversified portfolios.

Real-World Example: A Tokenized Investment

Imagine you have AED 10,000 to invest:

- With a traditional deed, you’d struggle to even make a down payment on a single property.

- With property tokens on PRYPCO Mint, you could purchase tokens in five different properties—for example, a Downtown Dubai apartment, a Business Bay studio, a villa in Palm Jumeirah, and two rental apartments in Dubailand.

This instantly spreads your risk and allows you to capture different types of income streams and market trends.

Risks to Be Aware Of

While property tokens offer exciting advantages, they are not risk-free:

- Real estate values can fluctuate, impacting your token’s underlying value.

- Token liquidity depends on the availability of buyers during exit windows.

- Returns (e.g., rental yields) are projections, not guarantees.

PRYPCO Mint clearly discloses risks for each property and ensures client funds are segregated, complying with VARA’s investor-protection standards.

Which Should You Choose?

If you’re an investor looking to diversify and gain real estate exposure with minimal capital, property tokens through PRYPCO Mint are the smarter option. They allow you to:

- Invest from as little as AED 2,000.

- Diversify across multiple properties.

- Access premium Dubai real estate that would otherwise be out of reach.

- Benefit from liquidity and digital efficiency.

If, however, you need full control over a single property, plan to live in it, or prefer long-term sole ownership, a traditional deed remains the best route.

In many cases, the optimal strategy is a blend of both: hold traditional deeds for core assets and use property tokens to expand and diversify your portfolio.

Disclaimer: This content is not an offer or solicitation to buy, sell, or hold virtual assets. Virtual assets are subject to market fluctuations, and investors may lose the full value of their investment. No financial protection applies. Please seek independent advice and review the Terms and Conditions before making any investment decision.