Dubai has always been at the forefront of innovation, especially in real estate. From record-breaking skyscrapers to futuristic infrastructure, the city consistently pioneers trends that set global benchmarks. Now, with the rise of blockchain technology and digital assets, Dubai is quickly becoming the ideal launchpad for real estate tokenisation — a disruptive investment model that brings greater accessibility, transparency and liquidity to property markets.

With visionary leadership, a robust property sector and clear regulatory frameworks, Dubai offers the ideal conditions for real estate tokenisation to thrive. Let’s explore the key factors that make Dubai the perfect market for this emerging technology — backed by data, trends and forward-looking initiatives.

What is real estate tokenisation?

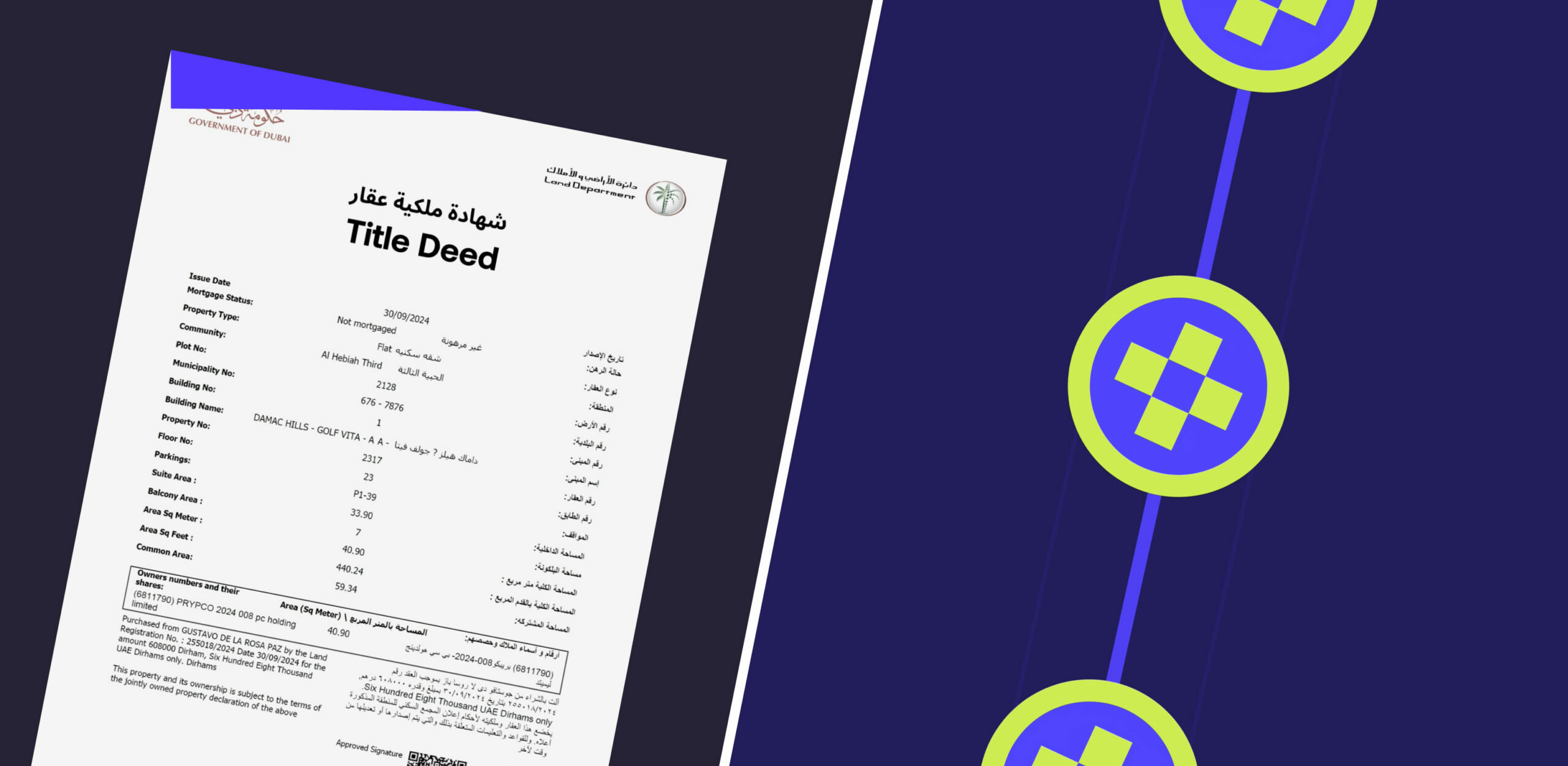

Real estate tokenisation is the process of converting the value of a physical property (real-world assets) into digital tokens (virtual assets) stored on a blockchain. These tokens represent fractional ownership in a property, allowing investors to buy and sell shares of real estate, much like stocks or cryptocurrencies.

Why tokenise real estate?

Traditional real estate is one of the world’s most trusted assets—stable, secure, and known for delivering strong long-term returns. But it comes with limitations: high entry costs, complex processes, and limited liquidity.

Tokenisation transforms real estate by breaking down these barriers. It makes investing faster, more flexible, and easier to access. With tokenisation, you can buy fractional shares of property, trade them more easily, and build a diversified portfolio without the traditional hassle.

Dubai’s real estate market: a powerhouse of growth

Dubai’s property sector has long been a magnet for global investors. The city offers a strong legal framework, no property tax and world-class infrastructure — all of which contribute to consistently high demand.

In 2024, the Emirate recorded AED 761 billion in real estate transactions — a 20% increase in value and a 36% year-on-year rise in volume, cementing its status as one of the most dynamic property markets globally. The total number of real estate investments reached 217,000, valued at AED 526 billion, reflecting impressive growth rates of 38% in number and 27% in value compared to the previous year.

Adding to this momentum, Dubai’s real estate sector witnessed 2.78 million procedures in 2024 — the highest in its history — including transactions and rental agreements, up 17% from 2023. These record-breaking figures highlight the city’s fast-tracked progress toward the Dubai Real Estate Strategy 2033, which aims to generate AED 1 trillion in sector transactions.

These figures demonstrate not only the strength of Dubai’s property market but also its openness to new forms of investment. It’s this dynamic growth and global appeal that make Dubai an ideal environment for tokenised real estate.

A global hub for blockchain and virtual assets

Dubai has positioned itself as a leading global centre for virtual assets and blockchain innovation. Over 1,000 blockchain and crypto companies now operate in the UAE, supported by forward-thinking regulations and business-friendly policies.

One of the key milestones was the establishment of the Virtual Assets Regulatory Authority (VARA) in 2022 — the world’s first independent regulator for virtual assets. VARA oversees the governance of all virtual asset activities in Dubai and provides clear guidelines for tokenised platforms to operate legally and securely.

Dubai’s leadership in the virtual asset space has attracted major global players, including Binance, Crypto.com and OKX, to establish regional headquarters in the city. This ecosystem of innovation creates the perfect backdrop for launching and scaling real estate tokenisation.

PRYPCO Mint: Leading the tokenisation movement in MENA

PRYPCO Mint is MENA’s first real estate tokenisation platform, built in partnership with the Dubai Land Department (DLD) and awaiting licence approval by VARA. PRYPCO Mint will enable investors to purchase fractional shares of premium Dubai properties starting from just AED 2,000, making real estate investing more inclusive than ever before.

What makes PRYPCO Mint unique is its direct ownership model. Each token purchased is backed by a certificate of ownership issued in the investor’s name — offering the same legal protection and ownership rights as traditional property, but with added flexibility and speed.

With PRYPCO Mint:

- Investors gain access to pre-vetted, DLD-approved properties

- All transactions are recorded on the blockchain for full transparency and security

- Investors can benefit from rental income and capital appreciation, with the ability to sell tokens on the platform’s Marketplace

Why Dubai’s market conditions are ideal for tokenisation?

Several unique factors make Dubai the perfect place to pioneer tokenised real estate:

1. High investor demand and global appeal

Dubai attracts investors from around the world thanks to its tax-free environment, investor visas and vibrant lifestyle. The city’s growing population of high-net-worth individuals and global entrepreneurs provides strong demand for flexible and innovative investment models.

2. Transparent regulations and strong legal frameworks

Dubai is one of the few cities with a government-led framework for tokenised assets, ensuring that innovation happens under strict compliance. The presence of DLD and VARA offers both legal backing and investor confidence.

3. Strong government vision

Dubai’s leadership is committed to becoming the capital of the digital economy. The Dubai Economic Agenda (D33) aims to double the city’s GDP within a decade, and tokenised real estate aligns perfectly with this vision. The Dubai Real Estate Strategy 2033 also targets AED 1 trillion in real estate transactions — an ambitious goal that tokenisation can help achieve.

4. Tech-savvy population and investor education

With one of the world’s highest smartphone penetration rates and a population well-versed in crypto and fintech, Dubai is well-positioned to adopt tokenised solutions quickly and at scale.

A look at global tokenisation trends

Dubai’s early adoption of tokenised property puts it ahead of global trends. According to Fortune Business Insights, the global tokenisation market is expected to grow from USD 2.3 billion in 2021 to USD 11.1 billion by 2028, at a CAGR of 25.2%.

Moreover, real estate is considered one of the most promising sectors for tokenisation due to the traditionally illiquid nature of property investments. Platforms like PRYPCO Mint can help unlock the value of trillions of dollars in global real estate by making it more liquid and accessible to retail investors.

Final thoughts

Dubai is not just ready for real estate tokenisation — it’s leading the charge. With a robust property sector, advanced digital infrastructure and supportive regulatory bodies, the city offers the perfect environment for this transformative investment model.

As PRYPCO Mint paves the way for tokenised ownership backed by legal title deeds and blockchain transparency, Dubai stands as a shining example of how technology and real estate can come together to create new opportunities for investors everywhere.

Whether you’re a first-time investor or an experienced player looking to diversify your portfolio, Dubai’s tokenised property market offers access, efficiency and innovation like never before.

If you do not have an Emirates ID, please join the PRYPCO Mint waitlist for international investors to be a part of the future of real estate. Click here to join the waitlist. Please note that only valid Emirates ID card holders can currently invest with PRYPCO Mint.

Source: Khaleej Times, Fortune Business Insights, DLD, VARA, Gulf News

Disclaimer: The waitlist rewards ended on 25th May 2025. This content is not an offer or solicitation to buy, sell, or hold virtual assets. Virtual assets are subject to market fluctuations, and investors may lose the full value of their investment. No financial protection applies. Please seek independent advice and review the Terms and Conditions before making any investment decision.