The Dubai real estate market has always been at the forefront of innovation. With increasing global interest in fractional ownership, digital assets, and real-world asset (RWA) tokenization, the emirate is once again positioning itself as a trailblazer—this time in real estate tokenization.

From traditional property transactions to SPVs and now tokenized title deeds, the way investors can access real estate is evolving rapidly. Let’s explore the difference between tokenized title deeds, SPV-based fractional ownership, and traditional property structures—what each model means, how they work, and where Dubai is heading in this fast-growing space.

Dubai’s move towards real estate tokenization

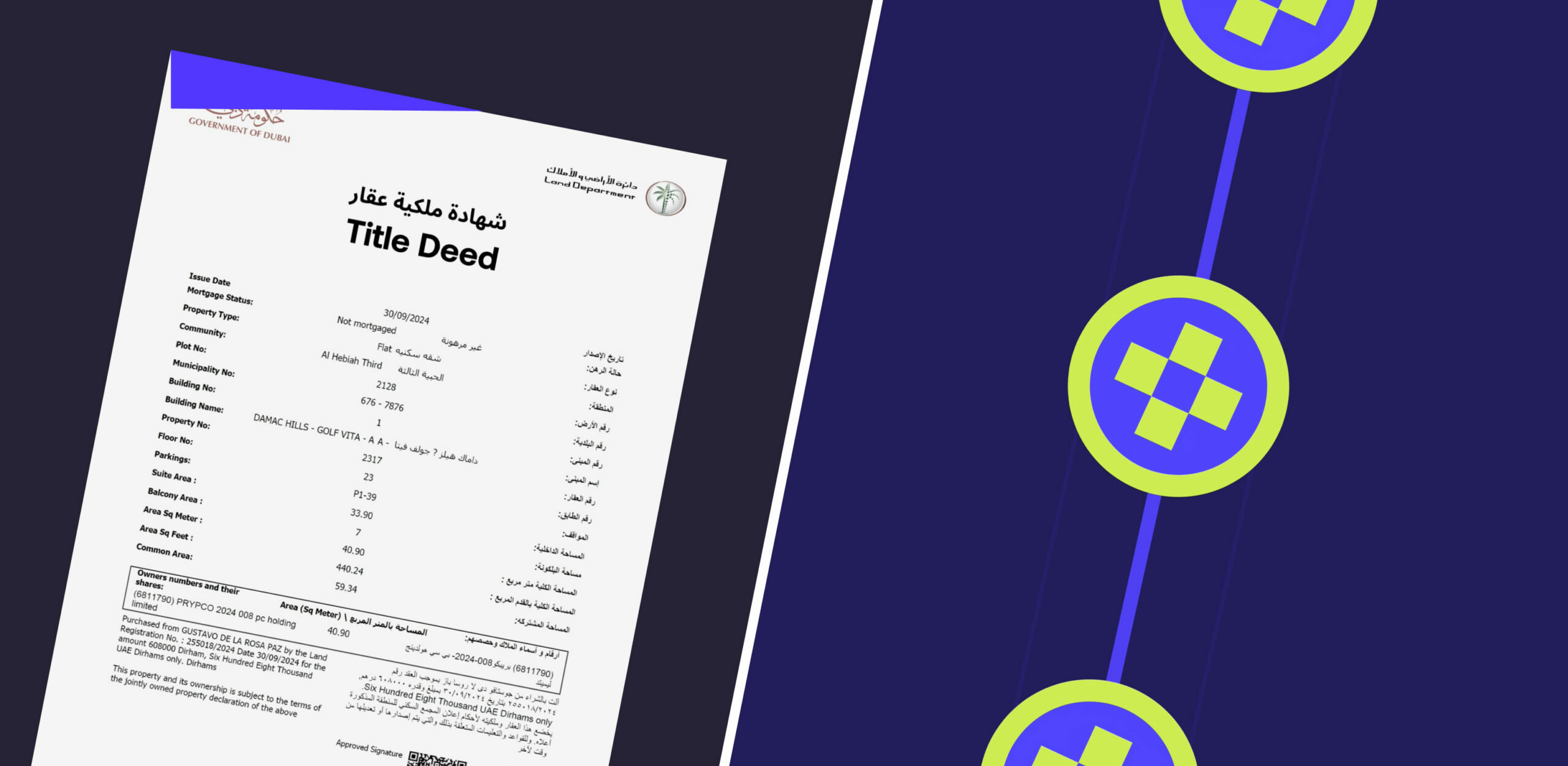

In March 2025, the Dubai Land Department (DLD) announced the pilot phase of its Real Estate Tokenization Project, marking a major milestone in the future of property investment. In strategic partnership with PRYPCO and licensed by the Dubai Virtual Assets Regulatory Authority (VARA), the initiative enables real estate assets to be tokenized and offered as fractional units on the blockchain. With this, PRYPCO Mint was born on 25/5/2025.

This forward-looking project aims to increase market liquidity, open up access to a broader base of investors, and solidify Dubai’s position as a global leader in the tokenization of real-world assets (RWAs).

What is tokenization in real estate?

Tokenization is the process of converting the ownership of a physical asset, such as real estate, into digital tokens on a blockchain. These tokens represent shares in the asset and can be bought, sold, or traded just like any digital asset.

There are different models for fractional ownership, but the two most prominent are:

- Tokenized title deeds, where the actual title deed is digitised and divided into tokens.

- Special Purpose Vehicles (SPVs), where a legal entity owns the property and investors own shares in that entity.

Let’s take a closer look at the differences.

Comparison: tokenized title deeds vs SPV ownership vs traditional real estate

| Feature | Tokenized Title Deeds | SPV Fractional Ownership | Traditional Real Estate |

| Structure | Direct ownership of a tokenized portion of the title deed | Indirect ownership via shares in a legal entity (SPV) | Sole or joint ownership of the entire property |

| Regulation | VARA & DLD-backed framework | Established in DIFC, ADGM, etc. Regulated by DFSA. | Regulated by DLD and other UAE authorities |

| Ownership rights | Proportional legal rights recorded on blockchain | Shareholder rights in SPV, indirect exposure to property | Full legal ownership rights are recorded on a title deed |

| Liquidity | High (tokens can be traded on digital marketplaces) | Moderate (shares can be sold or transferred with approval) | Low (property must be sold to exit) |

| Accessibility | High (investors can buy small fractions) | High (minimum investment usually lower than full property) | Low (high capital requirements) |

| Governance | Ownership certificates-based, minimal intermediaries | Governed by SPV’s corporate structure | Owner-controlled |

| Transparency | High (blockchain records transactions) | High (SPV disclosures, auditing) | Moderate (depends on individual transparency) |

| Example | PRYPCO Mint’s tokenized real estate platform | PRYPCO Blocks’ fractional model via SPVs | Buying a full flat or villa |

Why Dubai is uniquely positioned to lead MENA’s tokenization drive

Dubai has a strong foundation of regulatory innovation, investor-friendly frameworks, and government support. Initiatives by the DLD, Dubai Blockchain Strategy, and Virtual Assets Regulatory Authority (VARA) signal a long-term commitment to embracing blockchain in real estate and beyond.

The city is also home to a growing ecosystem of proptech firms and fintech hubs—like PRYPCO Mint and PRYPCO Blocks—that are developing new ways to make real estate more accessible, transparent, and liquid. This momentum puts Dubai at the heart of MENA’s push for RWA tokenization. According to a leading source, tokenization of real estate in the GCC could unlock billions in untapped investment, particularly from younger, tech-savvy investors who are seeking alternative and digital-first investment options. As regulatory clarity increases, Dubai is expected to attract global interest from both institutional and retail investors.

Understanding SPV-based ownership

While tokenized title deeds represent the newest evolution in real estate investing, SPV-based models have already been used successfully to enable fractional ownership.

In this model, a Special Purpose Vehicle (often a company or fund registered in DIFC, ADGM, or offshore jurisdictions) holds the title to a property. Investors then purchase shares in the SPV, effectively owning a portion of the underlying real estate. This structure provides clear legal frameworks and is familiar to regulators and institutional investors.

Platforms like PRYPCO Blocks use this method to offer investors access to premium Dubai properties with entry points starting from AED 2,000, making real estate investing more inclusive than ever before.

What about traditional real estate?

Traditional real estate still has a strong place in the Dubai market. Many investors prefer the stability, control, and long-term capital appreciation that come with owning a full property. The Dubai property market continues to perform well, with high rental yields and a consistent flow of foreign buyers.

However, traditional ownership comes with higher barriers to entry, less liquidity, and more complexity in terms of maintenance, legal paperwork, and exit strategies.

Key takeaways

- All three models—tokenized deeds, SPVs, and traditional ownership—have a place in Dubai’s real estate ecosystem. Each offers unique benefits depending on the investor’s goals, risk appetite, and capital availability.

- Dubai is setting the pace for real estate tokenization in MENA, with strong government backing and growing interest from global players.

- PRYPCO Mint and PRYPCO Blocks are among the platforms helping to shape the future of property investing in Dubai by combining transparency, technology, and user-friendly access to the real estate market.

- As regulation evolves, we can expect more clarity, security, and innovation in how real estate is bought, sold, and owned, not just in Dubai, but globally.

Final thoughts

Whether you’re a first-time investor looking to enter the Dubai market with a small ticket or a seasoned buyer interested in exploring digital ownership, understanding these models is essential. Tokenized real estate and SPV-based fractional ownership are not just trends—they’re part of a broader shift toward making real estate more accessible, digital, and efficient.

As Dubai moves forward with real estate tokenization, it continues to reinforce its position not just as a luxury property destination, but as a global pioneer in proptech and digital assets. For those interested in exploring fractional ownership opportunities, platforms like PRYPCO Blocks and tokenized real estate solutions from PRYPCO Mint offer a simple and secure way to get started.

Source: PwC Middle East, The future of tokenisation in the GCC