The UAE real estate market has been witnessing an unprecedented surge in the demand for mortgages owing to rising property prices.

In the first half of 2024, the total number of mortgage transactions in Dubai reached 19,618, marking a 9% increase compared to the same period in 2023. The total value of these mortgages exceeded AED 96 billion, according to DXB Interact.

In the UAE, there are several mortgage providers. However, visiting multiple websites and bank branches can be time-consuming. This is where PRYPCO can help you.

Read the blog to see why you should choose to work with PRYPCO Mortgage to navigate the intricate world of mortgages in the UAE.

What is PRYPCO?

PRYPCO is a proptech platform that simplifies the real estate journey in the UAE. Our single portal gives access to an entire ecosystem, which facilitates most aspects of real estate transactions.

True to our mission, we operate multiple business verticals and are ever-expanding as we identify areas where we can add value for different stakeholders. Our verticals currently include:

PRYPCO Mortgage: providing the best and most transparent mortgage deals

PRYPCO Golden Visa: facilitating Golden Visa processing services

PRYPCO Blocks: own a part of property for as low as AED 2000. PRYPCO Blocks is regulated by DFSA.

What is PRYPCO Mortgage?

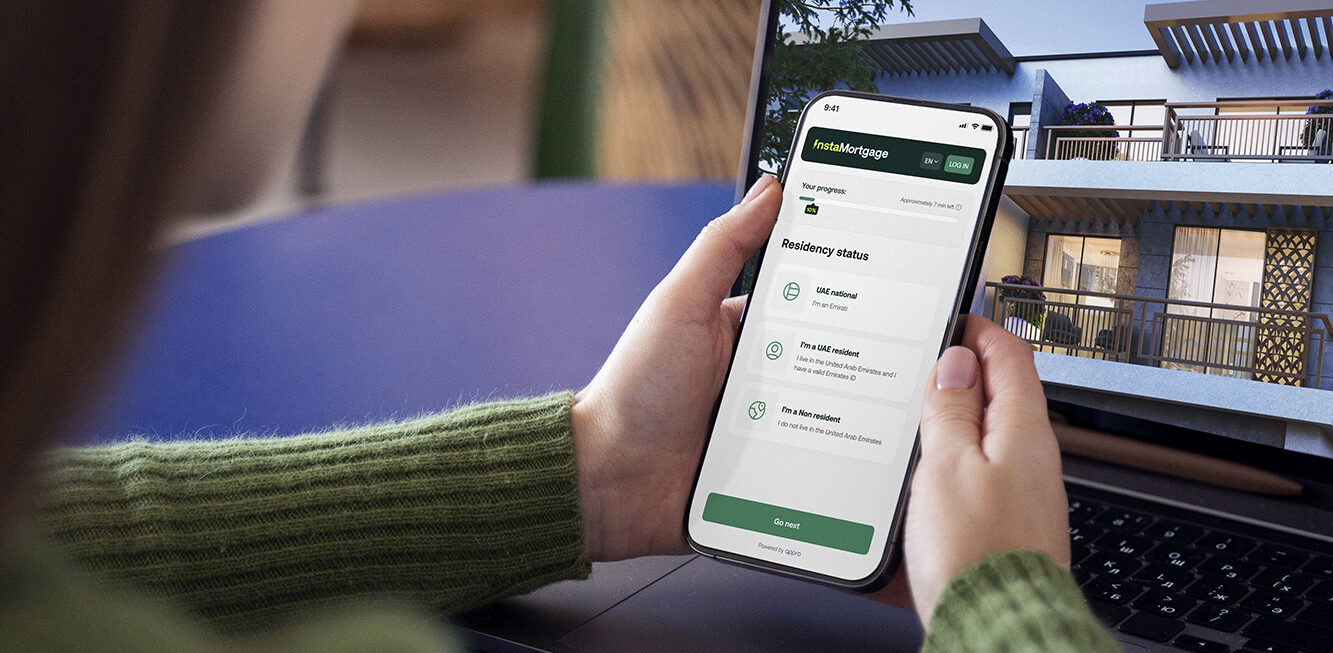

PRYPCO Mortgage is a platform where homebuyers can get the best mortgage solutions that can help them secure their dream home. From pre-approval to disbursal, PRYPCO helps throughout the mortgage process.

The platform enables homebuyers to compare deals from various lenders and also get the maximum loan-to-value ratio.

Why should you choose PRYPCO Mortgage?

Let us look at some reasons why PRYPCO Mortgage should be your go-to partner for all your mortgage needs in the UAE:

It is FREE!

PRYPCO Mortgage services come at no additional cost to you. Whether it is to get a pre-approval or complete the entire mortgage journey, we do not levy any fees on you.

The first step to obtaining a mortgage in the UAE is to get pre-approved. Get your pre-approval in 48 hours by clicking here.

Variety of mortgage solution

Whether you are a new home owner or wish to refinance your existing mortgage, we have got you covered.

PRYPCO Mortgage offers end-to-end mortgage solutions, including mortgages for new properties, refinancing, buyouts, equity releases, and more.

Personalised solutions and services

We understand that each client is unique and has different requirements, especially when it comes to mortgages. That’s why we provide personalised mortgage solutions for you.

To guide you through the complexities of the mortgage process, we also appoint a dedicated mortgage advisor for you. The mortgage advisor will assist you right from selecting the best offer and valuation until the mortgage is disbursed.

Tie-ups with top banks

PRYPCO has established strong partnerships with some of the UAE’s leading banks. This helps us provide you with the best mortgage deals with competitive interest rates and favourable terms.

The banks that PRYPCO has partnered with are:

- ADCB

- ADIB

- Ajman Bank

- Al Hilal Bank

- Arab Bank

- Bank of Baroda

- CBD

- Dubai Islamic Bank

- EmiratesNBD

- FAB

- HSBC

- Mashreq Bank

- NFB

- RAK Bank

- Sharjah Islamic Bank

- Standard Chartered

- UAB

& more

Transparent Process

PRYPCO Mortgage believes in transparency. We walk you through the entire mortgage application process, explaining all the intricacies, terms, and conditions, so you can make informed decisions.

Expertise and experience

The PRYPCO Mortgage team comprises seasoned professionals with extensive experience in the banking and mortgage industries. They are well-equipped to handle even the trickiest of mortgage cases, ensuring you receive the best possible advice and solutions.

In a dynamic real estate market like the UAE, partnering with the right mortgage consultant is crucial to achieving your property ownership goals.

By choosing PRYPCO Mortgage, you not only gain access to a wealth of experience and resources but also a trusted partner who is dedicated to helping you secure your dream property. Don’t miss out on the opportunity to simplify your mortgage journey and make your real estate dreams a reality with PRYPCO Mortgage.